September 11, 2023

Five-Minute Brief: Evaluating Climate Transition Alignment

Investors committed to net-zero must evaluate their investments to ensure they can decarbonize adequately to achieve their emissions reduction targets

Investors play an important role in supporting the transition to a net-zero greenhouse gas (GHG) emissions economy. Globally, investors representing USD 70 tn have made commitments to net-zero by 2050 or earlier.[1] To address these commitments, they must set GHG reduction targets for the emissions associated with their investments, also called financed emissions, and put measures in place to reduce them accordingly.

Financed Emissions

Financed emissions are the GHG emissions linked to the investment and lending activities of financial institutions, such as asset owners, asset managers, banks and insurers. Measuring financed emissions provides insight into an investor’s contribution to global GHG emissions as well as their exposure to climate-related risks – in particular, transition risks.[2] The Partnership for Carbon Accounting Financials has created the global standard methodology to calculate financed emissions.

Unlike corporate GHG inventories, where emissions are measured across direct and indirect business activities, investors need to account for emissions associated with a complex set of financing activities across several asset classes and economic sectors. For example, a hypothetical investor may have holdings in publicly traded companies in retail, manufacturing, industrials, real estate, and oil and gas. Each of these companies will generate varying amounts of GHG emissions, which provides one important view of transition risk. Another important view of transition risk is how well a company is prepared to reduce emissions and thrive in a low-carbon economy. For example, a commercial real estate company may have lower total emissions than a cement company. However, if the real estate company is not preparing to decarbonize its operations, it may be at greater risk than a cement company with a net-zero commitment, clear plan to reduce emissions and track record of action that is driving demonstrable progress to meet this goal. This is where transition alignment assessments come in.

What are transition alignment assessments?

Investors are increasingly assessing the net-zero alignment (or ‘transition alignment’) of their holdings to determine which holdings are:

- Positioned to thrive in a low-carbon economy (i.e., already net-zero or close to it)

- Preparing for the low-carbon transition (i.e., setting targets and taking action to reduce emissions)

- Not acting, and therefore not transition-aligned (i.e., no plans or steps to reduce emissions)

Transition Alignment Frameworks

Standards, taxonomies, benchmark methodologies, assessments and best practices are emerging to guide investor efforts to assess transition alignment.

Institutional Investors Group on Climate Change (IIGCC)

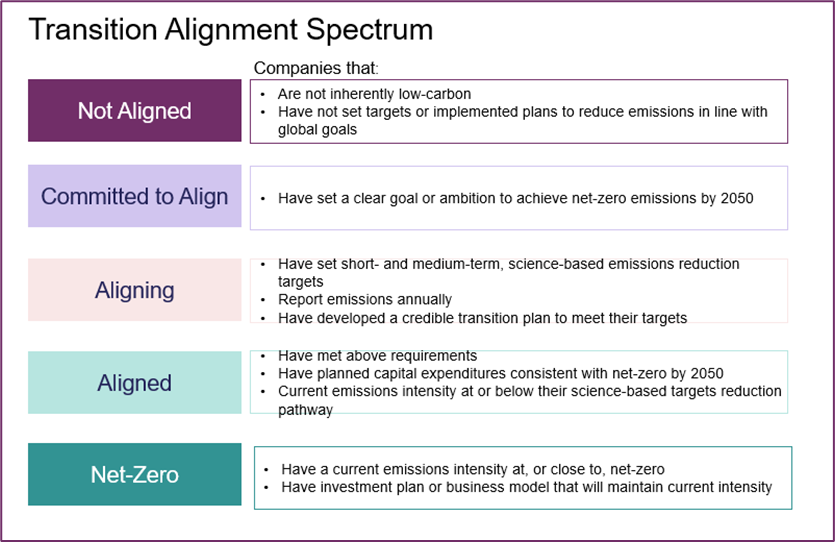

The IIGCC Net Zero Investment Framework provides a transition alignment framework (see Figure 1) for investors to evaluate holdings across and determine their place on a spectrum ranging from ‘Not Aligned’ to ‘Net-Zero’. As of November 2022, nearly half of all Net Zero Asset Managers Initiative (NZAM) targets used this framework[3].

Figure 1: IIGCC Net-Zero Investment Framework

Benchmark Methodologies

Several initiatives have emerged to ensure the world’s largest corporate emitters take climate action, including Climate Action 100+ and the Transition Pathway Initiative. Quinn+Partners and Manifest Climate are currently conducting an inaugural assessment of top Canadian emitters listed on the Toronto Stock Exchange against Climate Engagement Canada’s Net Zero Benchmark. The Benchmark provides a set of common indicators for investors to evaluate corporate issuers’ progress towards aligning with the Paris Agreement’s ambition. When used alongside the recently developed Taxonomy Roadmap Report by the Sustainable Finance Action Council, the Benchmark will provide Canadian investors with a standardized approach to measure companies’ performance against climate objectives and help define objectives for future climate engagements.

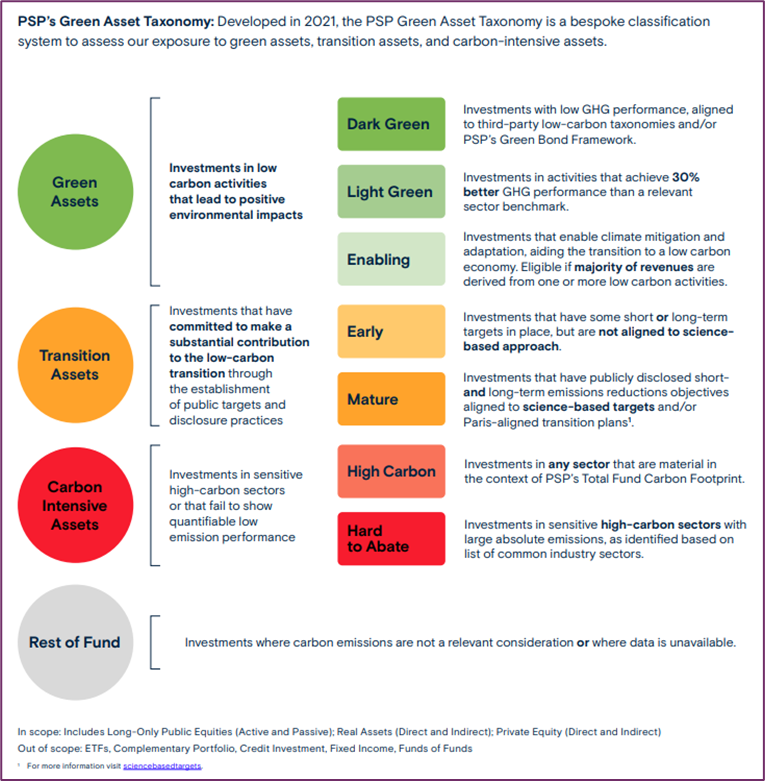

Case Study: Public Sector Pension Investment Board (PSP)’s Green Asset Taxonomy

PSP developed their own bespoke transition alignment assessment, the PSP Green Asset Taxonomy, which classifies portfolio holdings as ‘green’, ‘transition’ or ‘carbon-intensive’ (see Figure 2). Investments are considered ‘transition’ assets if they have short- or long-term targets in place and mature if they are science-aligned and have Paris-aligned transition plans in place. In 2022, PSP established a baseline for its portfolio covering public equities, real assets and private equity[4] and has set climate targets based on their taxonomy.

Figure 2: PSP Green Asset Taxonomy[5]

How to Get Started

Investors should begin assessing the transition alignment of their portfolio holdings. This is particularly important for sectors and asset classes that are high-emitting, difficult to decarbonize or otherwise significantly transition-exposed, thereby presenting potentially material financial risk. To do so, investors can:

- Review existing frameworks and peer best practices

- Understand whether their organization would need a custom framework to fit their values, investment strategy(ies) and resources, or a public framework can be used

- Establish a transition alignment framework and receive buy-in from management and investment teams

- Pilot transition alignment assessment on select holdings

- Review and expand assessment for second round

If you are an investor wanting to develop, implement and/or interpret a transition alignment framework for your portfolio, Quinn+Partners can help. Get in touch

[1] Net Zero Asset Managers Initiative and Net-Zero Asset Owners Initiative

[2] Transition risks arise from the shift to a low-carbon economy

[3]Net Zero Asset Managers Initiative

[4] https://www.investpsp.com/en/psp/investing-responsibly/

[5] https://www.investpsp.com/media/filer_public/02-we-are-psp/02-investing-responsibly/climate-strategy-2022/Climate-Strategy-Roadmap.pdf