October 17, 2022

Five-Minute Brief: Net-Zero Transition Plans for Financial Institutions

Financial institutions committed to net-zero must develop credible transition plans that align their lending and investment activities with global decarbonization goals

Financial institutions (FIs) have a crucial role to play in the global net-zero transition. They can provide much-needed capital to scale climate solutions, support companies to become transition-aligned and help facilitate the phase out of high-emitting sectors that are incompatible with the low-carbon economy.

Major FIs across the globe have committed to achieving net-zero greenhouse gas (GHG) emissions by 2050 at the latest, in alignment with the goals of the Paris Agreement and based on credible climate science published by the Intergovernmental Panel on Climate Change (IPCC). Many FIs choose to set their net-zero commitments through collective pledges and sector-specific alliances. The Glasgow Financial Alliance for Net Zero (GFANZ), for example, has more than 500 members collaborating on actions to accelerate the transition to net-zero across the global economy and is comprised of seven underlying initiatives, including[1]:

- Net Zero Banking Alliance (NZBA) comprised of 119 banks (US 70 tn in AUM)

- Net Zero Asset Managers (NZAM) initiative comprised of 273 asset managers (US 61 tn in AUM)

- Net Zero Asset Owners Alliance (NZAOA) comprised of 75 asset owners (US 11 tn in AUM)

If FIs are going to achieve their net-zero ambitions, the companies they invest and lend to must also set and achieve net-zero targets. However, scrutiny is increasing from investors, special interest groups and others around the misalignment between ambitious commitments made by FIs and the actual progress towards achieving net-zero emissions across their portfolios.

As a result, stakeholders are demanding that FIs articulate credible, science-aligned and actionable transition plans to which they can be held accountable. Membership in GFANZ and other sector-specific alliances require signatories to publicly disclose a transition plan within 12 months of signing on. Although membership in GFANZ is voluntary, there are very real reputational and liability risks associated with not meeting Alliance expectations. Furthermore, as governments look to strengthen domestic climate policies, failing to meet voluntary frameworks may catalyze shifts towards mandatory transition planning anchored in legislation. For example, the UK Government is moving towards mandating the publication of transition plans by FIs and UK-listed companies beginning in 2023.

What is a transition plan?

A net-zero transition plan is defined by GFANZ as “a set of goals, actions, and accountability mechanisms to align an organization’s business activities with a pathway to net-zero GHG emissions that delivers real-economy emissions reductions in line with achieving global net zero.”[2] In plain terms, it details how an FI will achieve its target. Transition plans should be consistent with achieving net-zero by 2050 at the latest and in line with efforts to limit global temperature rise to 1.5°C, with little to no overshoot.

Guidance for financial institutions

Guidance is emerging to develop net-zero transition plans focused on financed (portfolio) emissions, and consensus is forming around what constitutes a credible transition plan.

| Why financed emissions? |

The majority of an FI’s GHG emissions are attributable to financed emissions, which are the emissions that result from investments. Other sources of corporate emissions, such as those from purchased energy in office buildings or employee commuting, are relatively small in comparison. Financed emissions are therefore material for most FIs and have the largest potential opportunity to impact on decarbonization. They are also pervasive throughout the economy, indirectly controlled by FIs and difficult to measure effectively (enter the Partnership for Carbon Accounting Financials, or PCAF), presenting real but not insurmountable challenges for driving reductions.

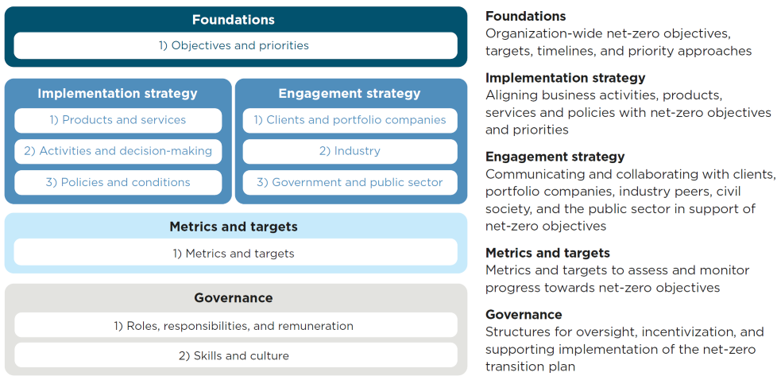

In June 2022, GFANZ released draft recommendations and guidance for public consultation to help FIs develop transition plans focused on their financed emissions. GFANZ asserts that a credible transition plan must be actionable, focus on short-term efforts and align with a 1.5°C warming pathway, and proposes a framework to support plan development. To meet GFANZ requirements[3], transition plans will need to, at minimum[4]:

- Establish actions to be carried out within 12 months, 2-3 years and by 2030

- Specify targeted GHG emissions reductions, including contribution of carbon removals

- Describe net-zero governance, including roles, responsibilities and reporting

- Outline financial planning requirements to execute on the transition plan

- Explain how the proposed approach deviates from business as usual

In developing and disclosing plans to decarbonize portfolio emissions, FIs should strive for consistency with industry guidance where possible, demonstrate credibility and be transparent and intentional in their approach to practically meeting their net-zero commitments.

Developing a net-zero transition plan

To develop a credible transition plan, FIs should model their portfolio emissions reduction pathways towards achieving their net-zero targets. This will determine potential abatement actions and the associated impacts of those actions on portfolio emissions reductions. In particular, FIs should look to accelerate the alignment of their products and services with their net-zero interim targets, ramp up client engagement efforts and develop new systems, tools, policies and processes that support net-zero decision-making across internal teams. This requires enterprise-wide change management. FIs should also put systems in place to track financed emissions reductions over time and report transparently on progress towards meeting their interim targets.

Given the scale and pace of change required to achieve net-zero financed emissions by 2050, without full integration into culture and decision-making across business activities, net-zero commitments cannot realistically be achieved.

[1] Sector-specific alliance membership statistics are as of October 2022

[2] Glasgow Financial Alliance for Net Zero (GFANZ). 2022. Recommendations and Guidance on Financial Institution Net-zero Transition Plans

[3] GFANZ is a partner organization of the UN-backed Race to Zero campaign. Race to Zero sets minimum commitment criteria, which the seven sector-specific alliances that comprise GFANZ translate into sector commitments. GFANZ members must meet the Race to Zero minimum criteria.

[4] Race to Zero. (2022). Interpretation Guide (Version 2.0 June 2022)