March 1, 2022

New Report Provides Guidance on Net-Zero Targets

A new report titled Breaking Down Real Estate Net-Zero Targets, aims to provide real estate funds and companies around the world with guidance on net-zero targets.

The report, published February 18, 2022 by MSCI, a leading provider of critical decision support tools and services for the global investment community, was developed with support from Quinn+Partners.

The report outlines best practices to set and manage comprehensive, ambitious and feasible net-zero targets:

- aligning with science and sector-specific decarbonization pathways

- setting interim targets

- adopting energy efficiency goals

- limiting carbon offsets

- incorporating both tenant and development emissions, even if estimated

- making public commitments

- linking progress to executive pay

- embedding the internal price of carbon in capex decisions

Breaking Down Real Estate Net-Zero Targets will be welcomed by funds and companies who still need to set greenhouse gas reduction targets as well as those that have set targets, but now need to implement or expand their target.

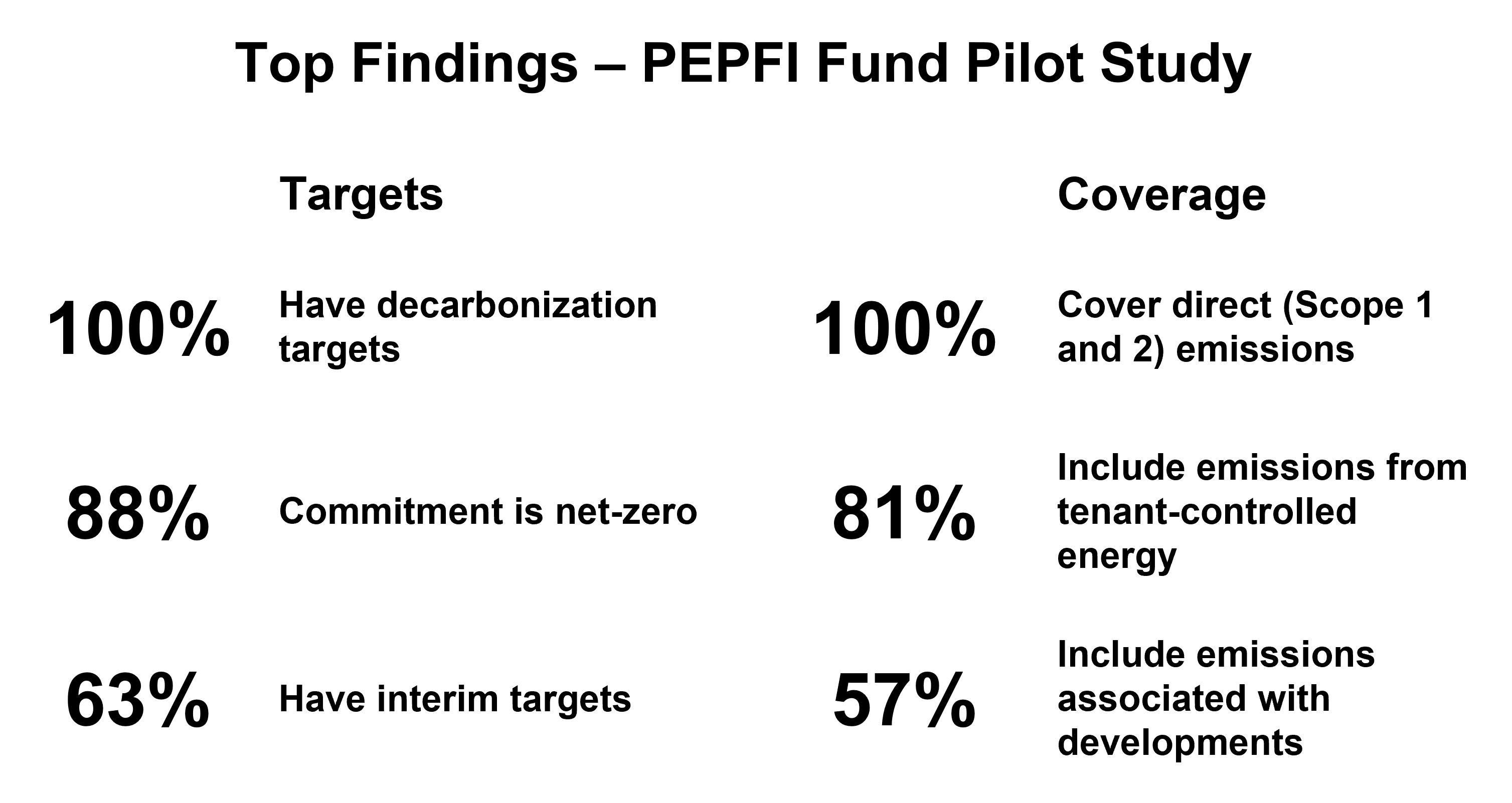

For the report, Quinn+Partners helped MSCI develop and pilot a consistent approach to evaluate property funds’ net-zero targets. The research team applied the target guidance on the 16 constituents of the MSCI Pan-European Property Fund Index (PEPFI) to obtain a snapshot of current practices in European real estate investments.

Partnering on pilot projects and industry reports like this latest one from MSCI are just two of the many ways Quinn+Partners is helping drive the transition to net-zero in the commercial real estate sector.